Stock Market Crash Today: What Happens Tomorrow and Beyond?

Updated Sept 29, 2023

The most effective approach to financial markets involves studying and recalling history. We delve into this subject within a historical context. More importantly, we showcase real-time actions taken by Tactical Investor. We practice what we preach, recognizing the consequences of ignoring history’s lessons.

Will you panic and let your emotions take control? Remember, panic is unwise when it comes to investing.

Those who wait and hope for a market crash are the ones who will miss out on potential gains while they hide in fear. History has shown that every stock market crash up to this point has eventually presented a long-term buying opportunity. This trend won’t change until fiat currency is replaced. Fiat currency is not likely to be replaced anytime soon, as the majority still consider it superior to gold.

Buy when the masses panic and sell when they become euphoric. Following this simple principle could lead to significant financial gains.

Is the Impact of a Stock Market Crash Today or Tomorrow Truly Significant?

As we have emphasised repeatedly, one should never give in to panic; when panic sets in, the outcome tends to be unfavourable. The masses often fail to grasp that when you feel overly confident about investing in the markets, it’s usually a sign that the markets are perilously close to a significant correction. Success in the markets often requires going against the crowd.

In stock market investing, there is no concept of teamwork. Collaborative efforts do not yield positive results and are more likely to result in disappointment. The masses cannot achieve victory because there isn’t sufficient wealth to accommodate everyone.

Embracing Trends: Your Ultimate Guide Through Market Noise

While some may argue that there is no magical formula to ensure success, they are mistaken. There is no magic but a straightforward and commonsense procedure combining mass psychology with very simple technical analysis. Essentially, this formula suggests that one should buy when the crowd is in a state of panic and sell when they are ecstatic. Now, combine this with simple technical analysis involving long-term charts.

When the group is anxious, and the markets are trading in a highly oversold range on long-term monthly charts, it’s time to establish long-term positions in excellent companies. Over the long term, there is not a single bear, whether alive or deceased, who can claim that shorting the markets is the recipe for long-term success.

In today’s rapidly evolving market landscape, staying attuned to emerging trends and adapting to the changing dynamics is crucial. Embracing trends can provide valuable insights and opportunities to navigate market noise. By blending the principles of mass psychology and technical analysis, investors can enhance their decision-making process and potentially maximize their returns.

When the market experiences a state of panic characterized by widespread fear and uncertainty, it often presents a favourable buying opportunity. This is because, during such periods, prices may be driven down to levels that do not reflect the intrinsic value of quality companies. Investors can identify oversold conditions by carefully analyzing long-term charts and strategically establishing long-term positions in fundamentally strong companies.

However, it is essential to note that embracing trends goes beyond simply buying low and selling high. It requires a comprehensive understanding of market dynamics and the ability to differentiate between short-term fluctuations and long-term trends. Successful investors recognize the importance of conducting thorough research, analyzing industry trends, and staying informed about macroeconomic factors influencing market movements.

Furthermore, embracing trends also entails being open to innovation and disruptive technologies. Technological advancements and changing consumer preferences are constantly reshaping the modern business landscape. Investors who proactively identify and capitalize on these emerging trends can position themselves for long-term success.

To successfully navigate through market noise, it is essential to maintain a disciplined approach and avoid being swayed by short-term market fluctuations. Investors can make informed decisions that align with their investment objectives by focusing on long-term goals and utilizing a blend of mass psychology and technical analysis.

In conclusion, embracing trends is a powerful strategy for investors seeking to navigate market noise. By combining an understanding of mass psychology, technical analysis, and emerging trends, investors can position themselves for long-term success in the dynamic and ever-changing financial markets.

Sentiment Normalization: A Shift in Mass Psychology

The data below was extracted from the July 23, 2023, Market Update:

And because sentiment patterns are normalising, Mass Psychology will work dangerously well.

Over the past 18 months, sentiment patterns have been anything but ordinary. One should never forget that whenever there is a deviation from the mean, it is always temporary. In the last seven weeks, bullish sentiment has surged, with the latest reading reaching 54.5, pushing it to the upper limit of our projected range (50-55). So, by default, Bearish readings will eventually surge to the 50-55 content and possibly higher. “The equation must and always does balance.”

We pay very close attention to mass psychology, and sentiment is an essential component of it. Hence, if bullish sentiment surges past 55, we will (not may) put all our plays on hold. This is covered in more detail under the General Market Commentary section.

The Stock Market Crash Today Story is a Fear-Driven Tactic

Forget the notion of an imminent stock market crash today; it’s merely a strategy to make you worry about a distant event with low likelihood. Meanwhile, you’re potentially missing out on significant profits by fixating on a far-off idea.

Focusing on the present is wiser, as it shapes the future. One clue for identifying market turning points comes from observing the masses. Until the masses become overly euphoric, there’s little reason to fear a stock market crash. Stock market bulls have historically ended on positive notes, and the masses are currently far from euphoric, as indicated by the two indicators below.

However, it’s essential to approach the financial markets with a rational mindset rather than succumbing to fear-driven tactics. While it’s natural for investors to be concerned about the possibility of a stock market crash, it’s crucial to assess the likelihood based on reliable indicators and data.

Fear is a poor guide; savvy investors recognize that fear might be helpful in the wilderness but won’t benefit you in the financial markets. Instead of panicking during market pullbacks, embrace them and consider buying when the trend is positive. Market pullbacks can present attractive buying opportunities for investors with a long-term perspective and willing to capitalize on undervalued assets.

Investors can make informed decisions that align with their investment objectives by focusing on the current market conditions and trends. Rather than being influenced by sensationalized headlines or fear-driven narratives, it is crucial to rely on thorough analysis and a comprehensive understanding of market dynamics.

It is worth noting that the financial markets are inherently unpredictable, and no one can accurately forecast future events with absolute certainty. Therefore, it is prudent to maintain a diversified portfolio, conduct thorough research, and seek professional advice when necessary.

While the idea of an imminent stock market crash today may be used as a fear-driven tactic, it is important for investors to stay focused on the present and make decisions based on reliable information and analysis. By embracing market pullbacks and maintaining a rational approach, investors can position themselves for long-term success in the ever-changing financial landscape.

Fear is a poor guide; savvy investors recognize that fear might be useful in the wilderness but won’t benefit you in the financial markets. Instead of panicking during market pullbacks, embrace them and consider buying when the trend is positive.

March 2020 Stock Market Update: Navigating Turbulent Times

Many doomsayers throughout history will have long passed before even a fraction of their predictions materialize. In times of a crash, there’s an opportunity to buy, and the coronavirus tests how swiftly social media can drive mass hysteria. Thus far, it has been a highly effective tool; the crowd often stampedes without verifying the facts.

This could be an excellent buying opportunity for traders willing to embrace some risk. It’s crucial to shift your focus from the short to the long term, as history consistently demonstrates the markets’ remarkable ability to trend upward. Bears who have persistently predicted market crashes have generally had a dismal long-term track record. Once the dust settles, markets tend to resume their upward trajectory, and this time is likely to be no different.

Take a look at how many people die a day from other causes and the flu https://www.worldometers.info/

Navigating Uncertainty Amidst Today’s Stock Market Challenges

In these uncertain times, viewing all sharp pullbacks from a bullish perspective is crucial. Ignore the noise and concentrate on the trend while building a list of high-quality companies you’d like to own. When the market experiences significant corrections, you’ll be prepared to acquire these companies at substantial discounts.

Undoubtedly, we’re currently facing one of the most challenging periods since the 2008 financial crisis. Hysteria has swept through everyone, particularly in the U.S., and it seems to be feeding upon itself, causing widespread panic. Before we proceed, let’s be clear: In the short term, we’ve endured significant losses; it’s a turbulent market out there.

However, despite having witnessed several crashes in the past, this situation is unprecedented. It’s not an invitation to throw caution to the wind; we will continue to deploy capital in a disciplined and controlled manner, adhering to the principles we’ve always advocated.

Tactical Investor Updated View on The Markets Jan 2019

Should You Fear Stock Market Crashes? Not.

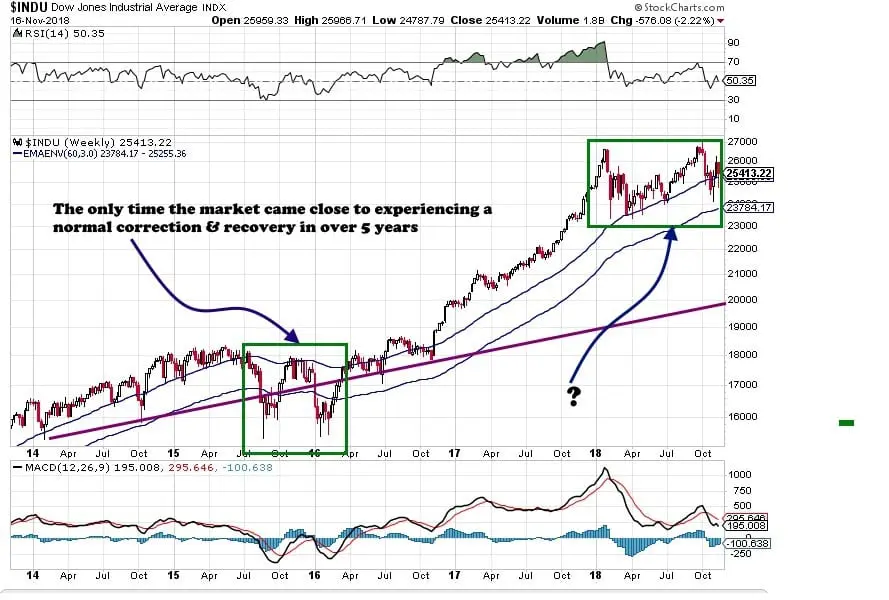

In our chart published in the September 17, 2018 update, we mentioned that the Dow would discover support in the low 24,000 range, and the subsequent rally would encounter resistance in the 25,700-26,000 range. This prediction has materialized, but the pullback from that zone has been somewhat more pronounced than anticipated. Is there a shift occurring?

Evolving Market Behavior: A Look Before and After 2009

In the years before 2009, the market’s behaviour followed a familiar pattern. After hitting bottom, there would be a rally, but it often lost momentum, leading to a pullback that tested previous lows or set new intraday lows before eventually trending higher. This kind of action served to shake out weaker, bullish investors. However, post-2009, a noticeable change occurred. Market pullbacks became sharper, and reversals happened at an even faster pace. With each passing year, these reversals, in general, accelerated.

When examining a five-year chart, the closest the market came to resembling pre-2009 behaviour was during the period between July 2015 and February 2016. Even then, each correction resulted in a “V-shaped” reversal. However, after the second rally that began towards the end of January 2016, the market exhibited behaviour reminiscent of earlier times. It soared initially, then trended sideways from April 2016 to nearly November 2016 before taking off explosively.

This observation suggests that market behaviour can evolve and change significantly over time. Investors need to adapt to these shifts and understand the implications of their strategies. We are witnessing a similar pattern, albeit spanning nine months, compared to the previous seven-month occurrence.

The market’s current behaviour indicates a prolonged period of consolidation and sideways movement, resembling the time frame observed in 2016. This suggests that investors may experience a period of slower market growth and potential volatility before a potential explosive move. It is essential to exercise caution, conduct a thorough analysis, and consider various factors, such as economic indicators, geopolitical events, and company fundamentals when making investment decisions.

As market behaviour continues to evolve, investors must stay informed, maintain a diversified portfolio, and adapt their strategies accordingly. By closely monitoring market trends, assessing risk factors, and staying focused on long-term goals, investors can navigate through changing market dynamics and position themselves for potential opportunities.

The market’s behaviour has witnessed significant changes since the 2009 financial crisis. Understanding these shifts and adapting investment strategies is key to navigating the ever-evolving economic landscape. By recognizing patterns, conducting thorough analysis, and staying informed, investors can make informed decisions and capitalize on market opportunities.

The Weekly Chart of the Dow with resistance and Support Points

This is the same chart as before, but now with two additional lines. Let’s focus on the first green box: the Dow traded below its previous highs for nearly a year before making a significant upward move. The two sharp corrections within the green box were excellent buying opportunities, just as we advised in February of this year and in October. However, as we’ve emphasized, the market didn’t break out until November 2016.

The levels between 26,900 and 27,000 represent a crucial resistance zone. Once the Dow consistently closes above this level on a monthly basis, the previous resistance is likely to transform into support. This shift could act as the catalyst to propel the Dow to levels as high as 27.5K and potentially even up to 30K. However, it’s essential not to become fixated on this possibility for now. It’s worth noting that after reaching such heights, the markets might experience a substantial and potentially back-breaking correction.

Economic Recovery: Fed’s Lifeline?

From the beginning of this bull market, we’ve maintained that this economic recovery had some questionable aspects. However, it’s essential to note that these issues don’t necessarily mean that the markets are destined to crash. Our stance remains unchanged: as long as the trend persists, we see no imminent crash.

Easy monetary policies have propped up both the US and global recoveries. If this supply of easy money were to be cut off, the seemingly miraculous recovery could halt. While there is potential for the massive tax cuts and government deregulation efforts to yield positive results over time, there are signs that this recovery might not be as robust as it appears. A case in point is the housing market, which shows signs of instability when interest rates hover around 3%.

Unless the Federal Reserve is willing to trigger a significant correction within the next year, it would be prudent for them to carefully reconsider their stance, especially given the past year’s trajectory. More details on this matter can be found in the bond market section of this update, which we will delve into later.